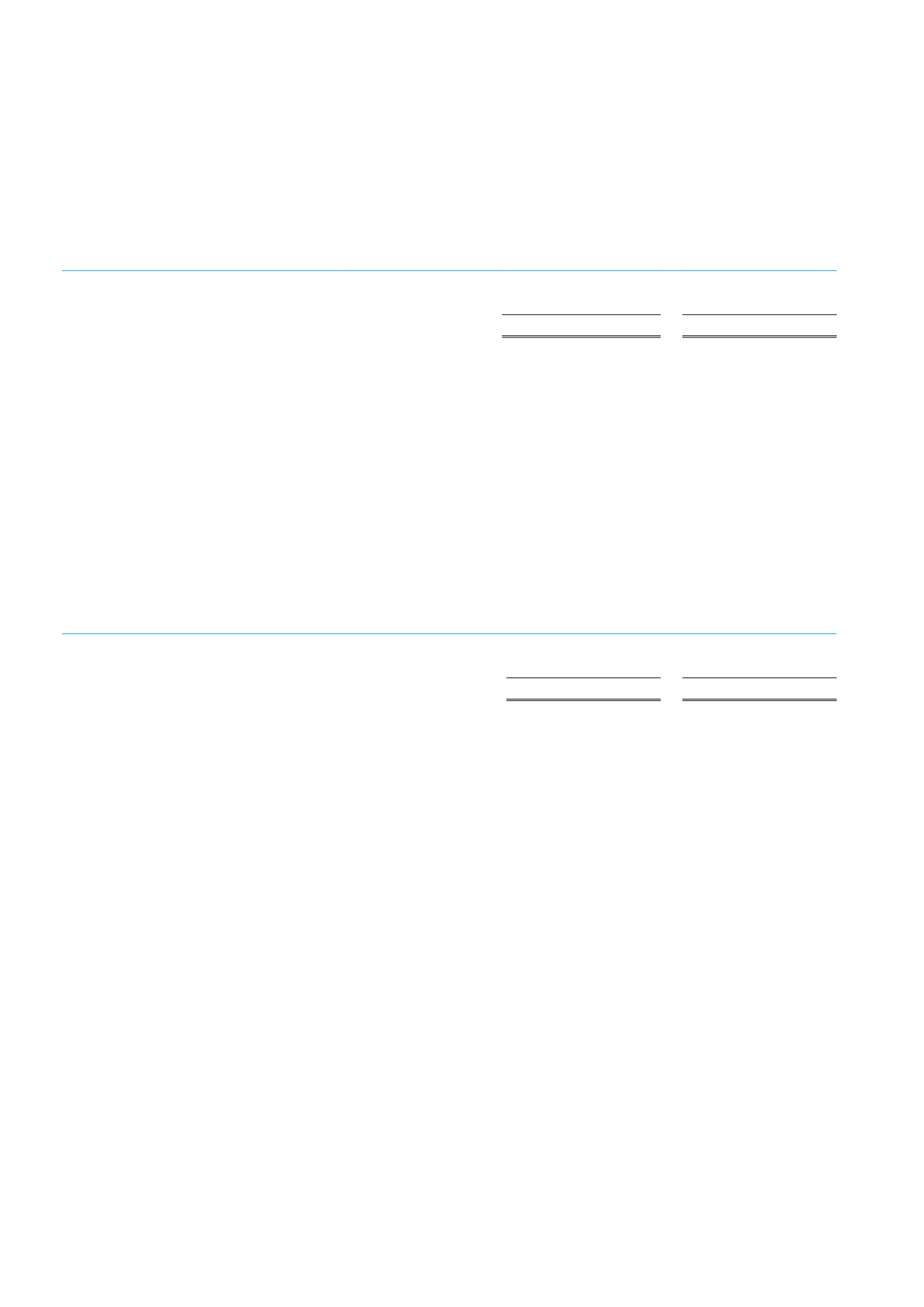

Financial assets that carry fixed interest rates are amounted to EGP 144 270

as at December 31, 2016 (EGP 175 867 as at

December 31, 2015).

December 31, 2016

December 31, 2015

Time deposits

USD

139 980

2 392

Time deposits

EGP

4 290

173 475

144270

175 867

B Credit risk

Credit risk is managed on a group basis. Credit risk arises from cash and cash equivalents, and deposits with banks, as well as

credit exposures to wholesalers and retail customers, including outstanding accounts and notes receivables.

For banks, the Group is dealing with the banks which have a high independent rating and banks with a good solvency in the

absence of an independent credit rating.

For suppliers and wholesalers, the Credit Controllers assess the credit quality of the wholesale customer, taking into account

their financial position, past experience and other factors.

For individuals the legal arrangements and documents accepted by the customer are minimizing the credit risk to its lowest

level. Provisions are accounted for doubtful debts on an individual basis.

The ratio of allowance for impairment of accounts and notes receivables to the total debts is as following:

December 31, 2016

December 31, 2015

Notes and accounts receivables

4 021 697

2 608 744

Impairment of accounts and notes receivable balances

(379 729)

(290 783)

The ratioof the allowance to total accounts andnotes receivable

9.44%

11%

C Liquidity risk

Prudent liquidity risk management implies maintaining sufficient cash, the availability of funding through an adequate

amount of committed credit facilities. Due to the dynamic nature of the underlying businesses, the Group’smanagement aims

at maintaining f lexibility in funding by keeping committed credit lines available.

2 Fair value estimation

The fair value of financial assets or liabilities withmaturity dates less than one year is assumed to approximate their carrying

value less any estimated credit adjustments.The fair value of financial liabilities – for disclosure purposes – is estimated by

discounting the future contractual cash f lows at the current market interest rate that is available to the Group for similar

financial instruments.

For the fair value of financial instruments that are not traded in an active market, The Group uses a variety of methods and

makes assumptions that are based on market conditions existing at each balance sheet date. Quoted market prices or dealer

quotes for the financial instruments or similar instruments are used for long-termdebt.

Other techniques, such as estimated discounted cash f lows, are used to determine fair value for the remaining financial in-

struments. At the balance sheet date, the fair value of non-current liabilities does not significantly differ from their carrying

amount, as the interest rates do not significantly differ.

2016 ANNUAL REPORT

92

GB Auto (S.A.E.)

Notes to the consolidated financial statements for the financial year ended December 31, 2016

(In thenotes all amounts are shown inThousandEgyptianPounds unless otherwise stated)