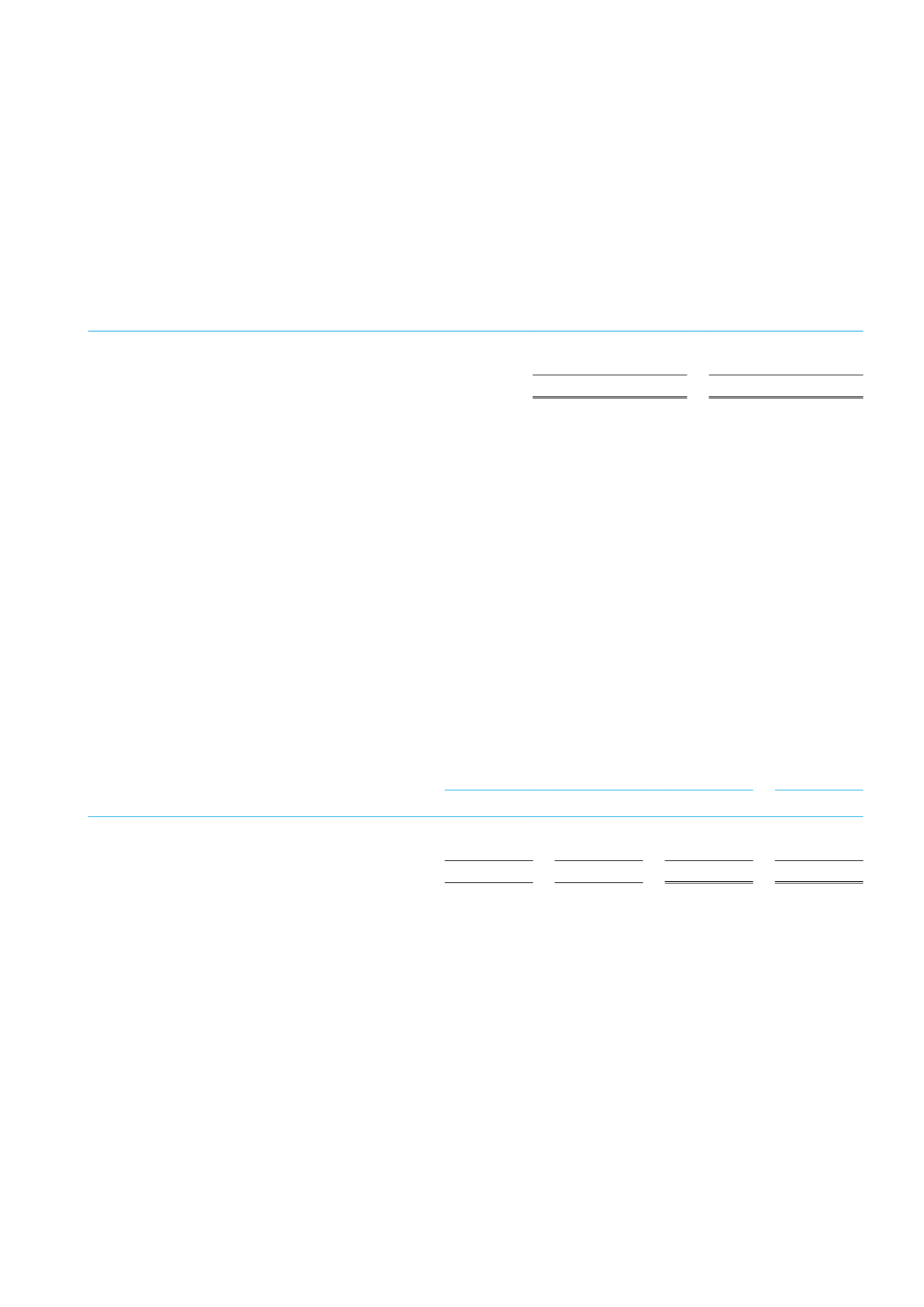

29 Amounts under settlement of financial lease contacts

This account represents the differences (either positive or negative) between the earned revenue which is recorded according

to revenue recognition policy inNote (35-D/4), and the due lease receivable.

Thebalanceof suchaccount is settledagainst thenet bookvalueof the leasedasset at the terminationdateof the leasing contract.

December 31, 2016

December 31, 2015

Advances fromcustomers

542 007

354 715

Amounts under settlement of financial lease contacts

226 687

130 155

768694

484870

30 Financial risk management

1 Financial risk factors

The Group’s activities expose it to a variety of financial risks: market risk (including foreign currency exchange rates risk,

price risk, cash f lows and fair value interest rate risk), credit risk and liquidity risk.

The Group’s efforts are addressed tominimize potential adverse effects of such risks on the Group’s financial performance.

A Market risk

1

Foreign currency exchange rate risk

The Group is exposed to foreign exchange rate risk arising from various currency exposures, primarily with respect to the

US Dollar and Euro. Foreign exchange rate risk arises from future commercial transaction, assets and liabilities in foreign

currency outstanding at the consolidated balance sheet date, and also, net investments in foreign entity.

The below table shows the exposures of foreign currencies at the consolidated balance sheet date, presented in EGP, as follows:

December 31, 2016

December

31, 2015

Assets

Liabilities

Net

Net

US Dollars

743 949

(3 197 480)

(2453 531)

(862869)

Euros

62 208

(40 189)

22019

2 324

Other currencies

242 018

(142 954)

99064

316626

- The Central Bank of Egypt had decided in its meeting held on November 3, 2016 to f loat exchange rates of foreign currencies,

to give the Egyptian banks more f lexibility in the process of pricing selling & buying foreign currencies.

2

Price risk

The Group has no investments in a quoted equity security so it’s not exposed to the fair

value risk due to changes in prices.

3

Cash f lows and fair value interest rate risk

The Group’s interest rate risk arises from long-term loans. Long-term loans issued at variable rates expose the Group to cash

f low interest rate risk. Long-termborrowings issued at fixed rates expose the Group to fair value interest rate risk.

Loans, borrowings and overdrafts at the balance sheet date with variable interest rates are amounted to EGP 8 732 109 as at

December 31, 2016 (EGP 5 233 274 as at December 31, 2015).

2016 ANNUAL REPORT

91

GB Auto (S.A.E.)

Notes to the consolidated financial statements for the financial year ended December 31, 2016

(In thenotes all amounts are shown inThousandEgyptianPounds unless otherwise stated)