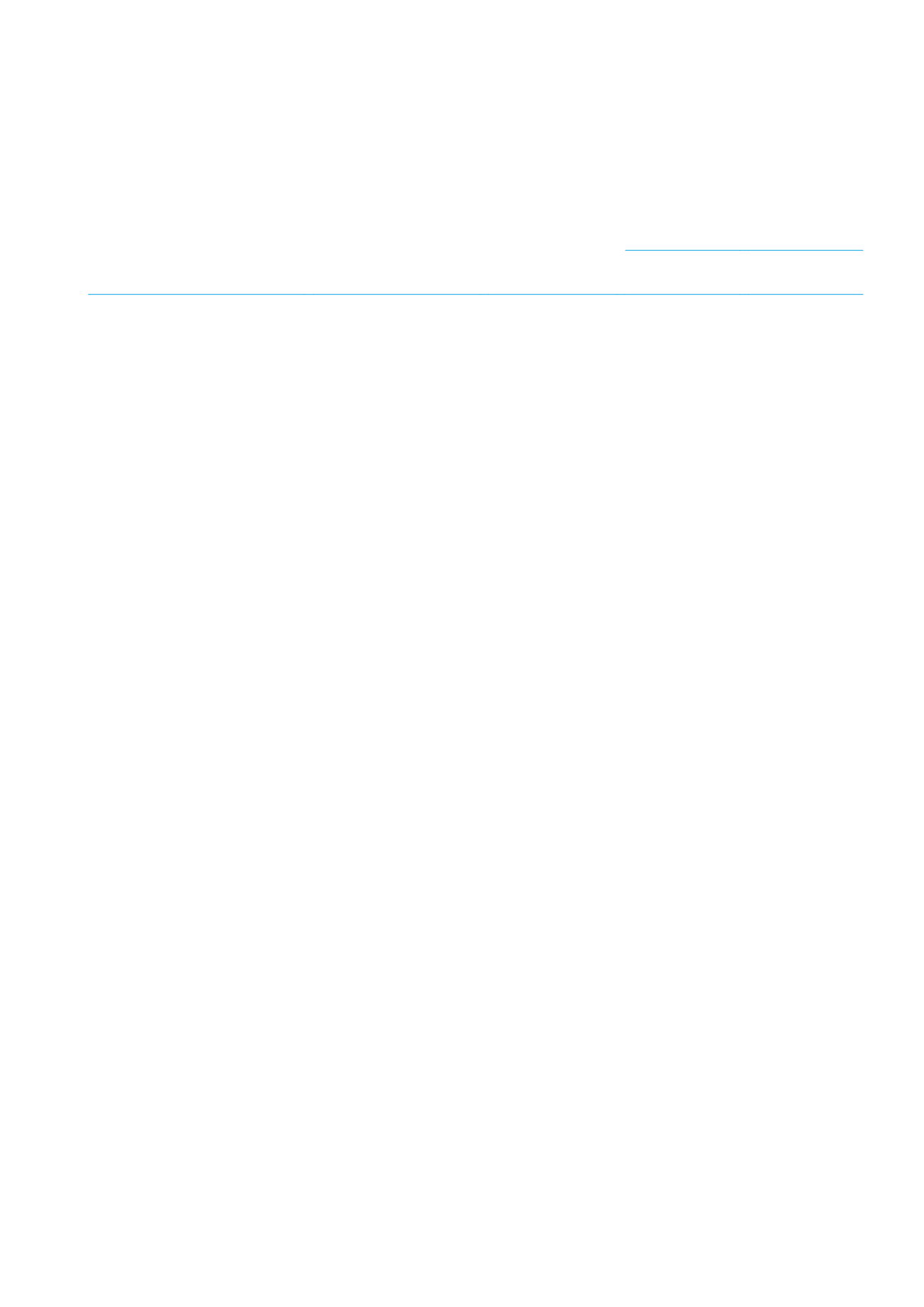

The following is the nature and the values for themost significant transactions with the related- parties during the year:

Transactionamount

Related party name

Relation type

Transaction

nature

December 31,

2016

December 31,

2015

Executive Directors

Boardof directormembers

Cash transfers

322

(2 453)

Topmanagement

salaries

30 444

22 312

EQI

Shareholder in one of the

subsidiaries

Dividends

(1 477)

-

GB Trade-In Co.

Shareholder in one of the

subsidiaries

Cash transfers

(1 477)

26

GB for import and export.

Related Party

Cash transfer

(8 512)

13 196

Al Watania for Vehicles Acces-

sories and spare parts

Related Party

Cash transfer

(3 698)

4 725

SARL SIPAC – Algeria

Related Party

Cash transfer

(1 020)

8 302

Kassed Shareholders› current

account

Shareholder in one of the

subsidiaries

Cash transfers

42 132

3 550

Dividends

-

(35 325)

Itamco agriculture development

Related Party

Cash transfers

866

134

El- QalamShareholder current

account

Shareholder in one of the

subsidiaries

Cash transfers

4 949

15 559

El-Nabateen Shareholders›

current account

Shareholder in one of the

subsidiaries

Cash transfers

(1 149)

311

GK Berlin Shareholder current

account

Shareholder in one of the

subsidiaries

Cash transfers

-

(3)

Marco Polo Company

Shareholder in one of the

subsidiaries

Cash transfers

(41 496)

(3 129)

Itamco for Import and Export

Related Party

Cash transfers

(3 841)

2 582

Al Watania for Tires Import

Related Party

Cash transfers

(3 335)

2 296

GKAuto Shareholder current

account

Shareholder in one of the

subsidiaries

Cash transfers

-

3 774

Blue BayManagement Company Shareholder in one of the

subsidiaries

Cash transfers

12 000

-

Algematco – Algeria

Shareholder in one of the

subsidiaries

Sales

8 912

-

35 Significant accounting policies

The principal accounting policies adopted in the preparation of these consolidated financial statements are summarized below:

A Business combination

• The Group accounts for business combination using the acquisitionmethodwhen control is transferred to the Group.

• Theconsiderationtransferredintheacquisitionisgenerallymeasuredatfairvalue,asaretheidentifiablenetassetsacquired.

• Any goodwill that arises is tested annually for Impairment. Any gain on a bargain purchase recognized in profit

or loss immediately.

• Transaction cost are expensed as incurred, except if related to the issue of debt or equity securities.

• The consideration transferred does not include amounts related to the settlement of pre-exiting relationship. Such

amounts are generally recognised in profit or loss.

• Any contingent consideration ismeasured at fair value at the date of acquisition. If anobligation to pay contingent consid-

eration that met the definition of financial instrument is classified as equity, then it is not re-measured and settlement is

accounted forwithinequity. Otherwise, other contingent consideration is re-measuredat fair value at each reportingdate

and subsequent changes in the fair value of the contingent consideration are recognized in profit or loss.

1 Subsidiaries

2016 ANNUAL REPORT

95

GB Auto (S.A.E.)

Notes to the consolidated financial statements for the financial year ended December 31, 2016

(In thenotes all amounts are shown inThousandEgyptianPounds unless otherwise stated)