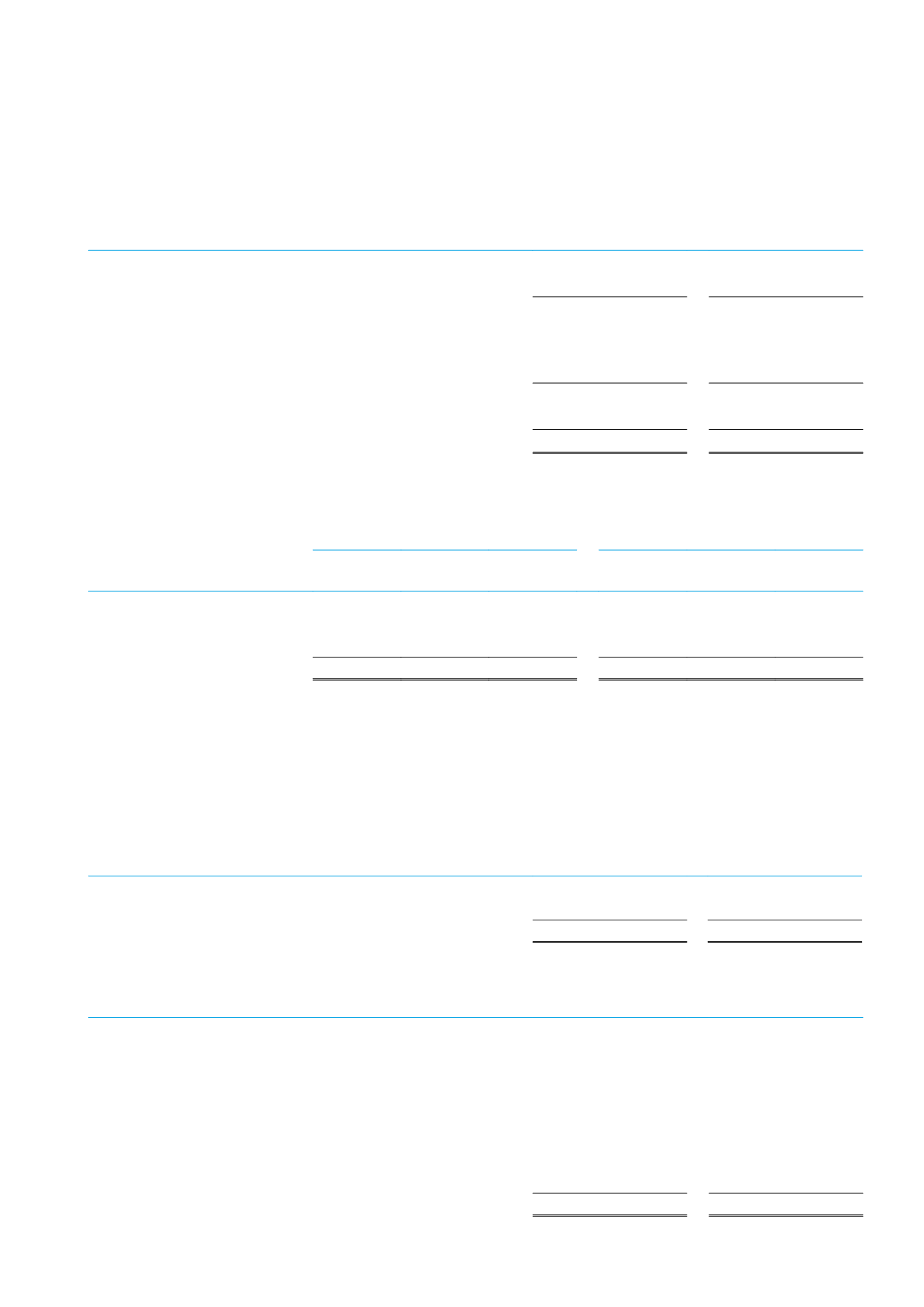

The gearing ratio at December 31, 2016 and December 31, 2015 were as follows:

Total loans and borrowings and notes payable

December 31, 2016

December 31, 2015

Loans, borrowings and overdrafts

8 732 109

5 233 274

Short-termnotes payable and suppliers

222 697

78 125

Total loans andborrowings andnotes payables

8954806

5 311 399

Less

: Cash and cash equivalent

(1 225 300)

(1 188 704)

Letters of credit margin

(83 437)

(521 906)

Letters of guaranteemargin

(56 813)

(19 966)

Net debt

7 589256

3 580823

Shareholders’ equity

3 821 710

3 334 446

Net debt to equity ratio

1.99

1.07

25

Loans, borrowings and overdrafts

December 31, 2016

December 31, 2015

Current

portion

Long-term

portion

Total

Current

portion

Long-term

portion

Total

Banks overdraft

6 474 248

-

6 474 248

3 862 541

-

3 862 541

Loans

594 371

1 554 772

2 149 143

472 260

817 779 1 290 039

Related parties’ loans

-

108 718

108 718

-

80 694

80 694

Total

7068619 1 663 490 8 732 109

4 334801

898473

5 233 274

A Banks overdraft

The average interest rate on the outstanding EgyptianPounds and theUSDollars bank overdraft are 17.31%and 4%respectively.

B Loans from related parties

The Group obtained loans from Marco Polo [a related party - Brazil] in US dollars with an interest rate of LIBOR + 3%. These

loans balance amounted to EGP 108 718 thousands as at December 31, 2016 and to be settled on an annual installment.

The analysis of the loans and banks overdraft balances according to their maturity dates is as follows:

December 31, 2016

December 31, 2015

Less than one year

7 068 619

4 334 801

More than one year and less than five years

1 663 490

898 473

8 732 109

5 233 274

26 Trade payables and other credit balances

December 31, 2016

December 31, 2015

Trade payables

1 958 888

1 277 279

Other credit balances

58 254

25 687

Advances fromcustomers

154 685

129 803

Tax Authority

25 973

53 495

Accrued expenses

372 944

220 278

Notes payables

222 697

78 125

Dividends payable

75

1 196

Deferred revenues

14 434

10 580

2807 950

1 796443

2016 ANNUAL REPORT

89

GB Auto (S.A.E.)

Notes to the consolidated financial statements for the financial year ended December 31, 2016

(In thenotes all amounts are shown inThousandEgyptianPounds unless otherwise stated)