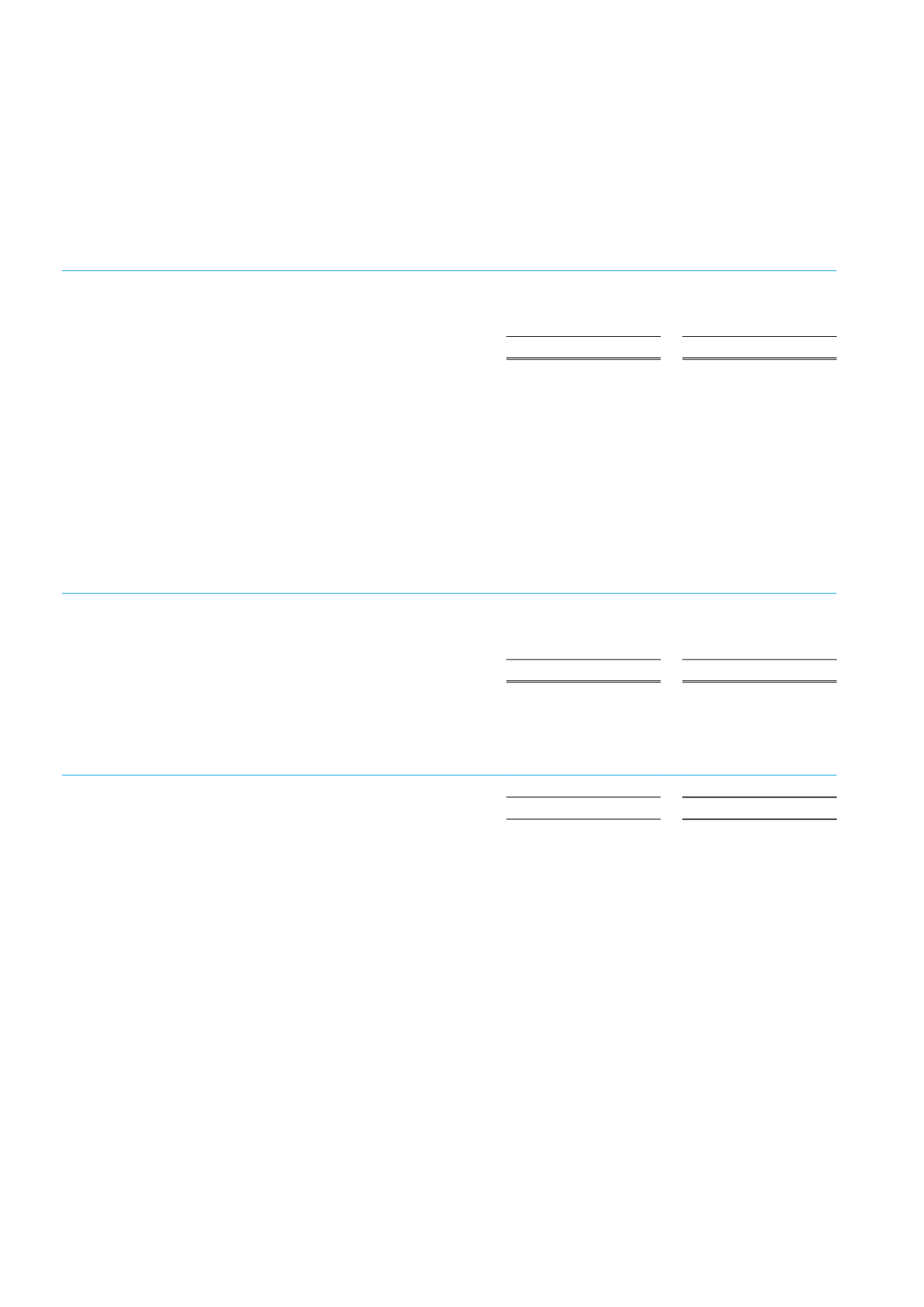

Impairment test of cash generating units including goodwill

Goodwill is allocated to the Group’s cash generating units according to operating segments as presented below:

December 31, 2016

December 31, 2015

Two and three wheels’ activities

177 375

177 375

Hyundai Iraq sales

253 557

109 690

Financial leasing activity

1 000

1 000

431 932

288065

The company assesses annually the impairment of goodwill at December 31, to ensure whether the carrying amount of the

goodwill is fully recoverable, unless there are indicators required to test the impairment through the year.

Impairment of goodwill is assessed based on value inuse, which is determined using the expected discounted cash f lows based

on estimated budgets approved by the Board of Directors covering five years’ period. The management is preparing these

estimated budgets based on the financial, operating andmarket performance in the previous years and its expectations for the

market development.

18 Investments property

December 31, 2016

December 31, 2015

Balance at 1 January

91 512

606

Additions during the year

-

3 565

Developed investment property revaluation – Gain

-

87 341

Balance at the endof the year

91 512

91 512

19 Issued and paid in capital

December 31, 2016

December 31, 2015

Authorized capital (5 000 000 000 shares with par value EGP 1 each)

5 000 000

5 000 000

Issued and paid capital (1 094 009 733 shares of EGP 1 each)

1 094010

1 094010

• At the date of August 31, 2014, the Board of Directors according to the delegation of the extra ordinary assemblymeeting

held on March 27, 2013, has decided unanimously to increase the Company’s issued capital with the par value in the

limit of the authorized capital with an amount of EGP 6 444 645 divided on 6 444 645 shares with a par value of 1 EGP /

share, wholly allocated to ESOP systemwhich is applied by the company, resulted in an issued capital of EGP 135 337 545

after the increase divided on 135 337 545 shares with a par value of 1 EGP/share, and this increase financially fully paid

from the special reserve balance and annotated in the commercial register at December 31, 2014.

Private placement (Capital Increase)

• At the date of February 4, 2015, the extra ordinary general assembly meeting, has agreed to increase the company’s

authorized capital from 400 million EGP to 5 billion EGP and to increase the company’s issued capital from EGP 135 337

545 to be EGP 1 095 337 545 with an increase of EGP 960 000 000 to be divided on 1 095 337 545 shares with a par value

of 1 EGP each.(In additional to issuance cost of 1 pts./share), and that increase to be fully allocated for the favor of old

shareholders each according to their share in the company’s issued capital , and it is agreed to use the subscription right

separately from the original share, with the company’s issued capital increase to be paid either cash and/or using due

cash debts for the subscriber by the company according to their contribution share.

2016 ANNUAL REPORT

86

GB Auto (S.A.E.)

Notes to the consolidated financial statements for the financial year ended December 31, 2016

(In thenotes all amounts are shown inThousandEgyptianPounds unless otherwise stated)