solid performances as the Passenger Car and Motorcycle &

Three-Wheeler businesses recover. In addition, management

continues to place emphasis on efficiency and operating

in a resourceful manner. Management expects to see the

Automotive Directive, a legislation that aims to benefit local

assemblers and open up new opportunities for GB Auto and

other local producers, finalized before the end of 2017.

In the Passenger Car segment, management acknowledges

the downside risk to the line of business due to the f loat of the

Egyptian pound and how the move has impacted consumer

demand. As it did throughout 2016, GB Auto plans to continue

formulating cost-cutting schemes and pricing policies that

will preserve margins and allow the company to leverage

its leading market position and capitalize on the long-term

upside. We also believe consumers will soon adapt to the new

price realities and expect demand to pick up and return to

close-to-normal sales levels before the end of the year.

Motorcycles and Three-Wheelers are anticipated to make an

even faster recovery thanPassenger Cars as the segment serves

consumer demand for transportation. Performance is expected

tobegin topickup starting 2Q17.

We are strong believers in the Commercial Vehicles & Con-

struction Equipment line of business due to the ramp-up in

investments in infrastructure development in Egypt and the

government turning its attention to transport demand. GB

Auto secureda leadershipposition in the city and intercity seg-

ments in 2016 with several successful deliveries throughout

the year. GBAuto is also set to benefit fromthe steady recovery

in tourismafter having to re-penetrate themarket in 2016.

The After-Sales division is one that has come into particular

focus during the year, having performed exceptionally well

as customers maintain their current vehicles through GB

Auto’s network amid concerns about the price of replacement

vehicles. The segment is expected to continue providing a

cushioning against hits taken by other lines of business and

boosting the company’s profitability in 2017 and beyond.

TheTiredivisionshouldalso see anuptickgoing forward,with

solid performance seen in 2016 despite strained foreign cur-

rency supply. GB Auto introduced inMay its own brand Verde,

added representations such as Double Coin andWestlake, and

extended its business cooperation with ZC Rubber, proving

that it remains committed to the segment and plans to expand

its tire supply and boost brand representations in the future.

Meanwhile, our Financing Business is expected to continue

outperforming in the coming year after having delivered

strong results in FY16 that boosted the company’s profitability.

GB Auto continues to take a measured approach to its Regional

activities, opting for long-term growth rather than short-term

payoffs. In Algeria, it is adjusting to regulatory reforms to see

operations ramp-up, with tire representations being received

well. The Iraqimarket continued to be pressured into 2017, hav-

ing experienced turbulentmarket conditions throughout 2016.

It is likely turmoil will remain a feature of themarket for some

time, but private-sector actors who stay the course will be ide-

ally positioned to benefit froma potential turnaround.

Finally, we note that guidance going forward remains subject

to change in light of f luctuating regional geopolitical and

macroeconomic conditions as well as the ongoing foreign

exchange and local currency challenges in Egypt.

Y-o-Y Increase in Group

Revenues

24.6

%

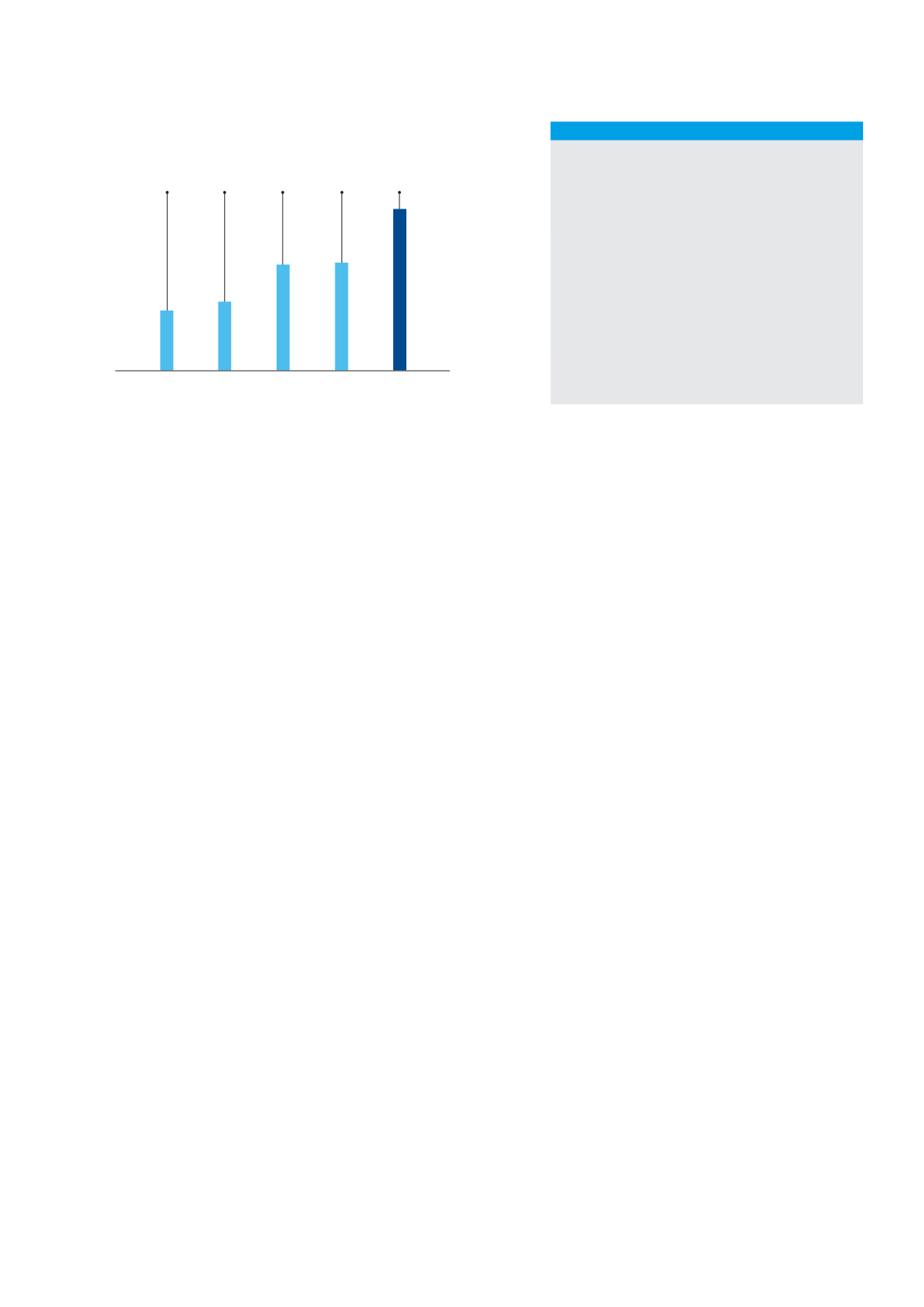

Group Gross Profit by Year

(LE million)

1,170.3 1,581.7

2,202.1

1,603.9

1,071.6

2012 2013 2014

2016

2015

2016 ANNUAL REPORT

15