GB Auto and its subsidiaries (S.A.E.)

Notes to the consolidated financial statements For the financial Year ended December 31, 2014

(In the notes all amounts are shown in Thousand Egyptian Pounds unless otherwise stated)

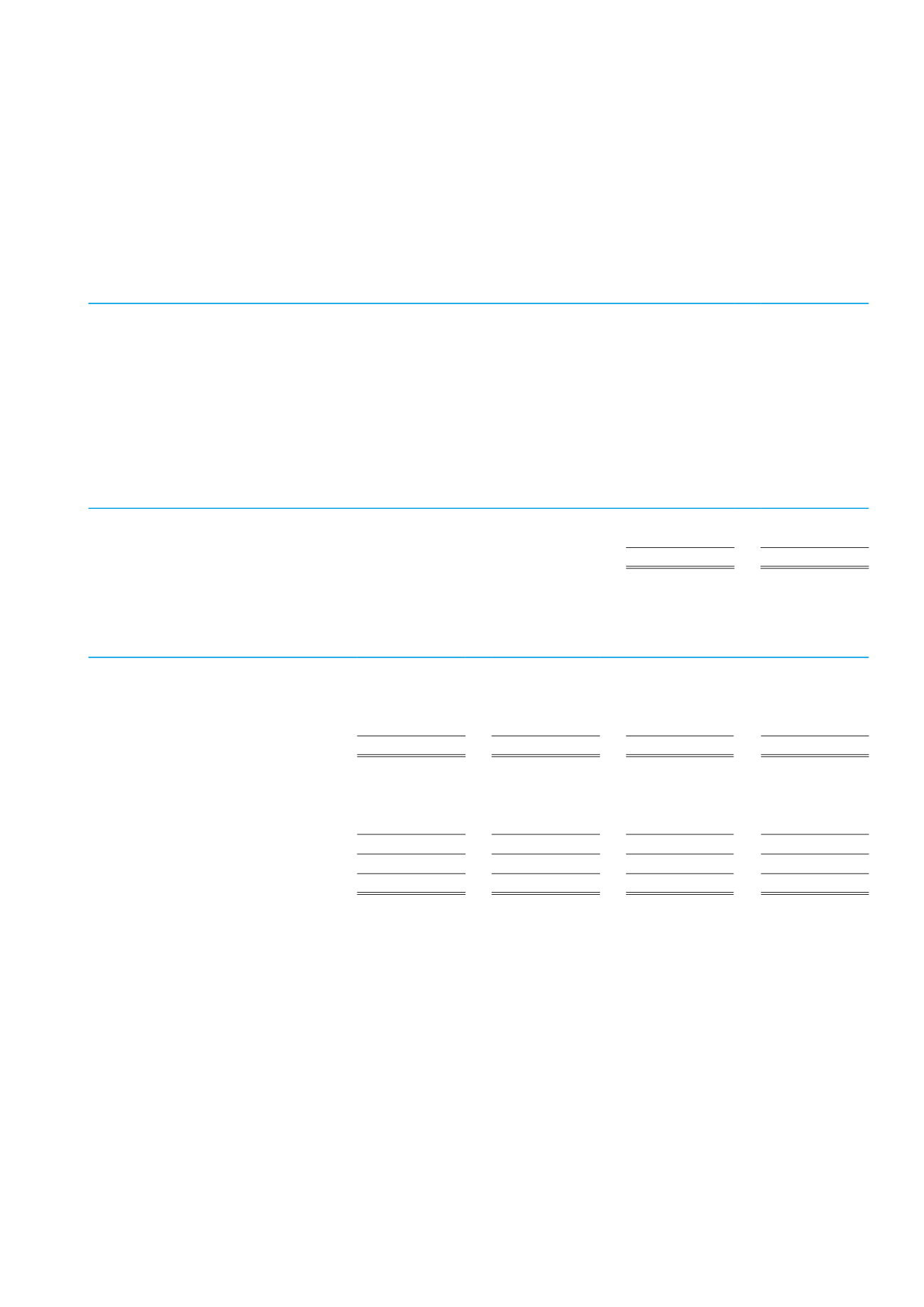

The Group has financial leased assets (trailers and buses) according to contracts under Law No. 95 for 1995, that is not considered

as property, plant and equipment according to the accounting policy (2/I) and according to the requirement of the Egyptian Ac-

counting Standard (No.20), according to, the annual lease payments are recognized as an expense in the income statement for the

year. and the leased contracts are as follows:

December

31, 2014

December

31, 2013

Total contractual lease payments

8 004

16 469

Total purchase price on termination of leases

23

40

Average contracts life

5 Years

5 Years

lease payments for the year

2 870

3 367

Financial leased assets

Property, plant and equipment include assets financially leased to others, under contracts which are subject to the provisions of the

Law No. 95 for 1995, and it recognized as fixed assets as follows:

December

31, 2014

December

31, 2013

Cost

1 351 070

628 559

Accumulated depreciation

(191 382)

(126 349)

Net book value

1 159 688

502 210

6. Intangible assets

Goodwill

Computer

software

Knowhow

Total

Cost

Balance at January 1, 2014

276 136

18 498

5 703

300 337

Foreign currency translation differences

2 823

-

-

2 823

Additions

-

1 262

-

1 262

Balance at December 31, 2014

278 959

19 760

5 703

304 422

Accumulated amortization

Balance at January 1, 2014

-

14 616

5 703

20 319

Amortization charge

-

1 647

-

1 647

Balance at December 31, 2014

-

16 263

5 703

21 966

Net book value at December 31, 2014

278 959

3 497

-

282 456

Net book value at December 31, 2013

276 136

3 882

-

280 018

Goodwill

• On March 28, 2007, the Company and its subsidiaries fully acquired the shares of Cairo Individual Transport Industries “CITI”

by acquiring 49.03% which were owned by the minority at a value of EGP 209 997, in return of acquiring shares of GB Auto

share capital increase (Note 22-C). The acquisition resulted in a goodwill amounting to EGP 177 million which represents the

increase in the acquisition value over the book value of the acquired Company’s acquired assets. This goodwill has been al-

located as an asset of the business of two and three wheels segment.

• On September 8, 2008, the Company and its subsidiaries fully acquired the shares of GB for Capital Lease (S.A.E) which its

business is financial leasing with all its fields, and the acquisition resulted in goodwill amounted to EGP 1 m.

• During November 2010, the Group entered into 50% investment as a joint venture agreement in Almajmoa Alalamia Litijaret

Alsaiarat (GK), in Jordan, to acquire the existing business of Hyundai Vehicles Agency in Iraq, the joint venture agreement

gives the group the power to govern the financial and operating policies of (GK). and as a result of this investment the group

recognized a goodwill.

Ghabbour Auto | 2014 ANNUAL REPORT

67