GB Auto and its subsidiaries (S.A.E.)

Notes to the consolidated financial statements For the financial Year ended December 31, 2014

(In the notes all amounts are shown in Thousand Egyptian Pounds unless otherwise stated)

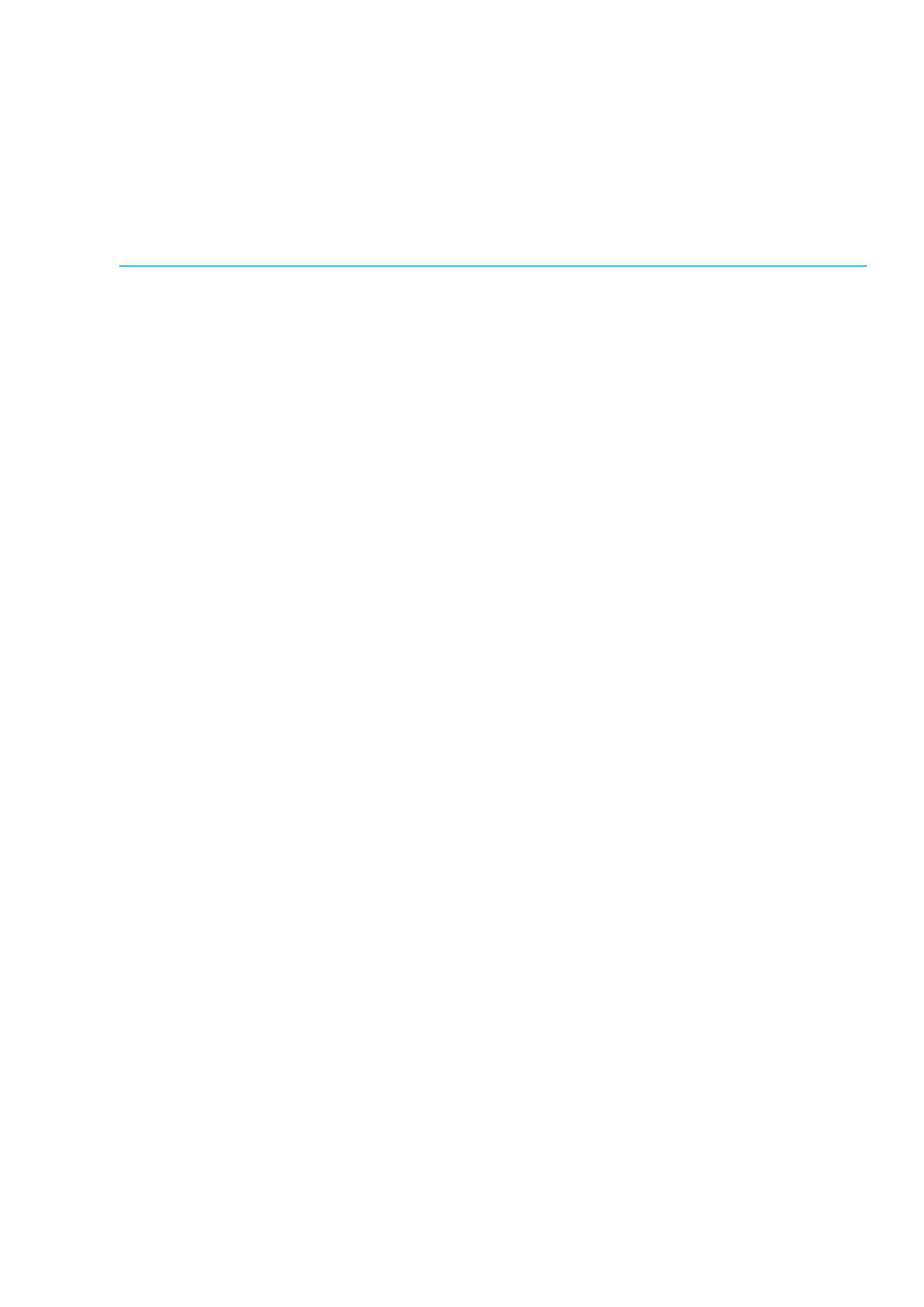

The gearing ratio at December 31, 2014 and December 31, 2013 were as follows:

December

31, 2014

December

31, 2013

Total loans and borrowings and notes payable

Loans, borrowings and overdrafts

4 825 691

3 311 975

Notes payable (short-term)- suppliers

143 458

132 431

Notes payable (long-term) and creditors

-

150

Total loans and borrowings and notes payables

4 969 149

3 444 556

Less: cash and cash equivalent

(1 177 577)

(1 085 105)

Net debt

3 791 572

2 359 451

Shareholders’ equity

2 136 141

2 011 302

Total Shareholders’ equity

5 927 713

4 370 753

Gearing ratio

64%

54%

3. Fair value estimation

The fair value of financial assets or liabilities with maturity dates less than one year is assumed to approximate their carry-

ing value. The fair value of financial liabilities – for disclosure purposes – is estimated by discounting the future contrac-

tual cash flows at the current market interest rate that is available to the Group for similar financial instruments.

The fair value of financial instruments that are not traded in an active market is determined by using valuation techniques.

The Group uses a variety of methods and makes assumptions that are based on market conditions existing at each balance

sheet date. Quoted market prices or dealer quotes for similar instruments are used for long-term debt.

Other techniques, such as estimated discounted cash flows, are used to determine fair value for the remaining finan-

cial instruments. At the balance sheet date, the fair value of non-current liabilities do not significantly differ from their

carrying amount.

4. Critical accounting estimates and judgments

1. Critical accounting estimates and assumptions

Estimates and assumptions are continually evaluated and are based on historical experience and other factors, including

expectations of future events that are believed to be reasonable under the circumstances.

The Group makes estimates and assumptions concerning the future. The resulting accounting estimates will, by definition,

seldom equal the related actual results.

The estimates and assumptions that have a significant risk of causing a material adjustment to the carrying amounts of assets

and liabilities within the next financial year are outlined below.

(a) Impairment of accounts and notes receivables

The evaluation of the impairment value in accounts and notes receivables is made through monitoring aging of the re-

ceivable. The Group management is studying the credit position and the customers’ ability to pay their debts falling due

within the credit limits granted to them. Impairment is recorded at values of the due amounts on the customers where

the Group management determine that their credit position does not allow them to settle their liabilities.

(b) Warranty provision

The Group provides warranty for the manufacturing defaults concerning the local manufactured products.

The warranty provision is estimated based on the expected cost for providing the warranty service. These costs include

the value of spare parts, labour cost and a share of indirect costs. This estimation is based on management experience

resulting from the actual warranty costs for the 3 preceding years. Management does not take into consideration the

present value of the expected warrant cost when estimating the warranty provision, and also the inflation rate is not

considered for this purpose.

Ghabbour Auto | 2014 ANNUAL REPORT

65