GB Auto and its subsidiaries (S.A.E.)

Notes to the consolidated financial statements For the financial Year ended December 31, 2014

(In the notes all amounts are shown in Thousand Egyptian Pounds unless otherwise stated)

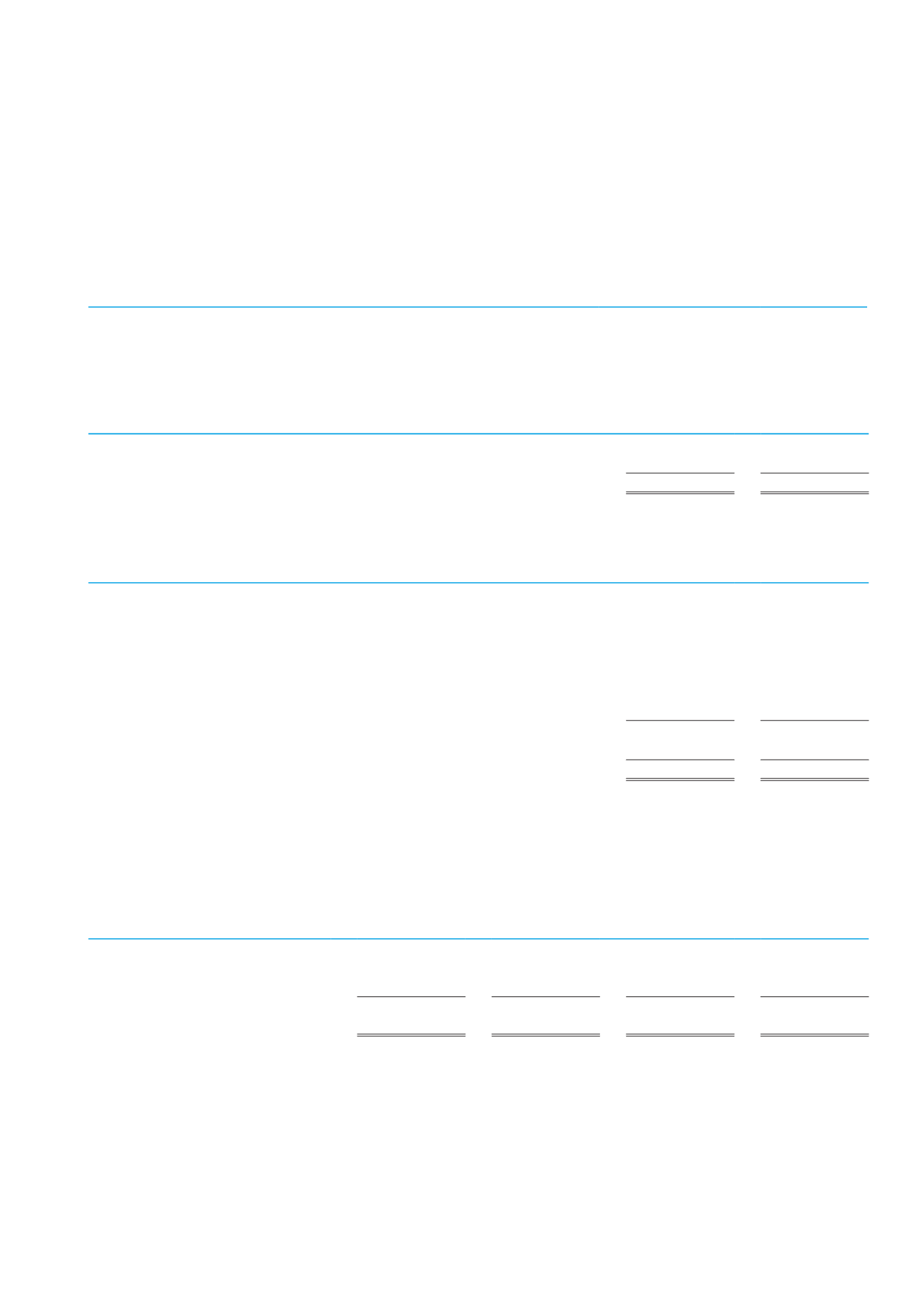

Unrecognised deferred tax assets

Some deferred tax assets were not recognized due to the uncertainty that those items will have a future tax benefit.

December

31, 2014

December

31, 2013

Allowance for impairment of accounts and notes receivables

67 291

66 034

Allowance for impairment of other debit balances

1 628

2 434

9. Investment property

December

31, 2014

December

31, 2013

Balance at January 1, 2014

3 117

3 117

Disposals of the year

(2 511)

-

Balance at the end of year

606

3 117

10. Inventories - Net

December

31, 2014

December

31, 2013

Goods in transit

553 443

966 728

Cars, buses and trucks

789 228

599 528

Raw material and car components

683 671

321 781

Spare parts for sale

231 478

190 607

Work in progress

55 043

24 231

Tires

77 710

54 565

Lubricants

1 056

-

Total

2 391 629

2 157 440

Impairment of cost lower than net realizable value

(45 920)

(29 851)

Net

2 345 709

2 127 589

11. Assets held for sale

Land

Building

December

31, 2014

December

31, 2013

Total

Total

Cost

300 471

14 288

314 759

314 759

Accumulated depreciation

-

(1 615)

(1 615)

(1 615)

Net book value at the

end of the Year

300 471

12 673

313 144

313 144

Assets held for sale represented in lands and buildings which the board of directors of the subsidiaries decided to sell it as no

longer benefits holding it within the companies’ assets.

The Companies’ management has decided to keep the long term assets within the same classification according to the con-

tinuance of the company’s management intention to use these assets as well as having the capability of doing so.

Ghabbour Auto | 2014 ANNUAL REPORT

69