GB Auto and its subsidiaries (S.A.E.)

Notes to the consolidated financial statements For the financial Year ended December 31, 2014

(In the notes all amounts are shown in Thousand Egyptian Pounds unless otherwise stated)

Combination that at the time of the transaction affects neither accounting nor taxable profit nor loss. Deferred income tax

is determined using tax rates (and laws) that have been enacted or substantially enacted by the balance sheet date and are

expected to apply when the related deferred income tax asset is realised or the deferred income tax liability is settled.

Deferred income tax assets are recognised to the extent that it is probable that future taxable profit will be available against

which the temporary differences can be utilised.

Deferred income tax is provided on temporary differences arising on investments in subsidiaries and associates, except

where the timing of the reversal of the temporary difference is controlled by the Group and it is probable that the temporary

difference will not reverse in the foreseeable future.

X. Segmental reporting

Business segments provide products or services that are subject to risks and returns that are different from those of other

business segment. Geographical segments provide products or services within a particular economic environment that is

subject to risks and returns that are different from those of components operating in another economic environment.

Y. Dividends

Dividends are recorded in the Group’s financial statements in the period in which they are approved by the Group’s share-

holders.

Z. Comparative figures

Where necessary, comparative figures have been reclassified to conform to changes in presentation in the current period.

3. Financial risk management

1. Financial risk factors

The Group’s activities expose it to a variety of financial risks: market risk (including foreign currency exchange rates risk, price

risk, cash flows and fair value interest rate risk), credit risk and liquidity risk. The Group’s efforts are addressed to minimize

potential adverse effects of such risks on the Group’s financial performance.

Market risk

(i) Foreign currency exchange rate risk

The Group is exposed to foreign exchange rate risk arising from various currency exposures, primarily with respect to

the US Dollar and Euro. Foreign exchange rate risk arises from future commercial transaction, assets and liabilities

in foreign currency outstanding at the consolidated balance sheet date, and also, net investments in foreign entity.

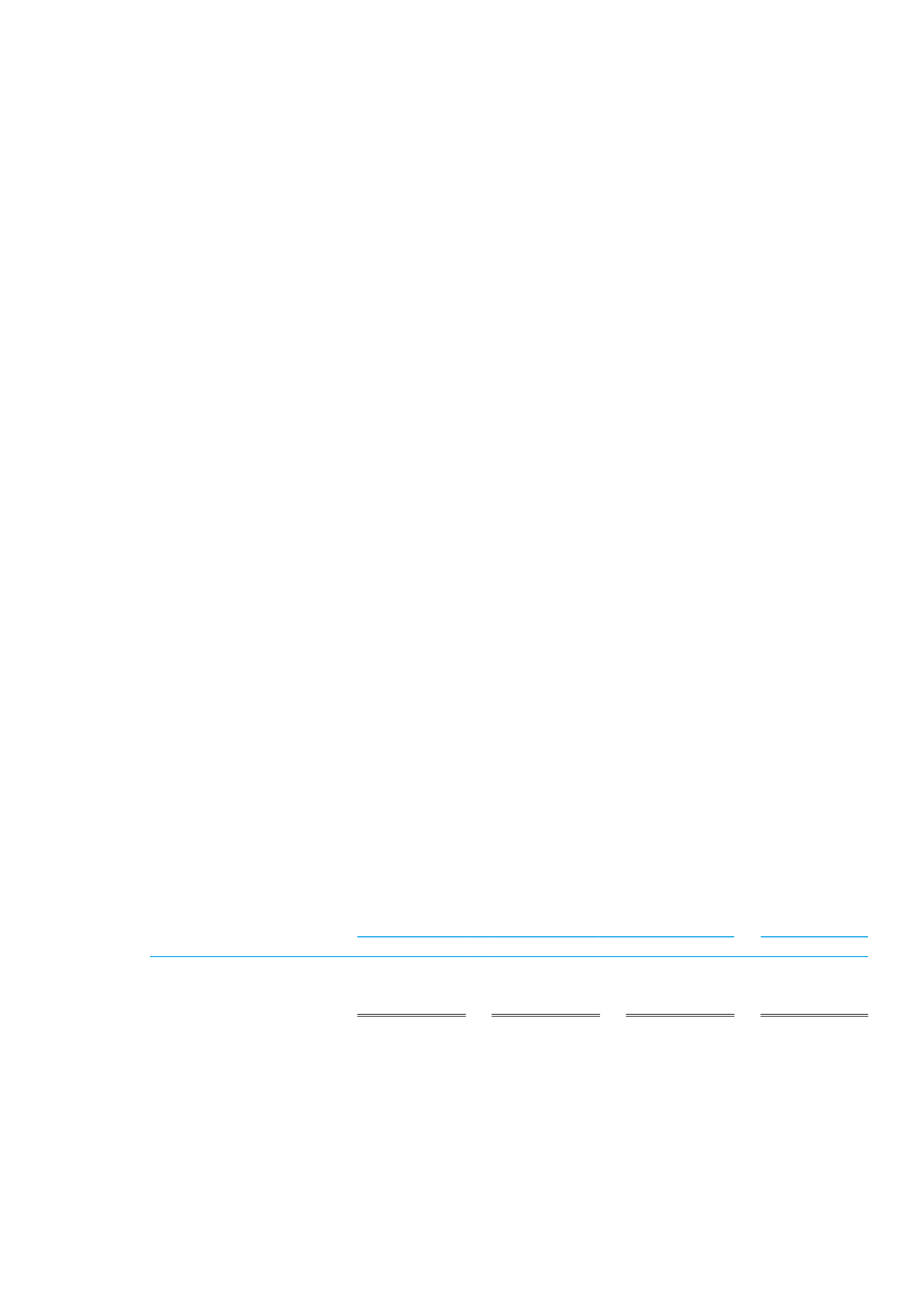

The below table shows the foreign currency positions at the consolidated balance sheet date, presented in EGP, as

follows:

December 31, 2014

December

31, 2013

Assets

Liabilities

Net

Net

US Dollars

176 066

(567 045)

(390 979)

(54 872)

Euros

2 140

(6 156)

(4 016)

(1 977)

Other currencies

73 013

(97 900)

(24 887)

7 497

(ii) Price risk

The Group has no investments in a quoted equity securities so it’s not exposed to the fair value risk due to changes

in prices.

(iii) Cash flows and fair value interest rate risk

The Group’s interest rate risk arises from long-term loans. Long-term loans issued at variable rates expose the Group

to cash flow interest rate risk. Borrowings issued at fixed rates expose the Group to fair value interest rate risk.

Loans, borrowings and overdrafts at the balance sheet date with variable interest rates are amounted to EGP 4 825

Ghabbour Auto | 2014 ANNUAL REPORT

63