Tires

GB Auto has been among Egypt’s leading tire distributors

for more than 50 years. The company distributes Passenger

Car, van, bus, construction equipment, light-truck, truck, and

bus-truck tires frommanufacturers including Turkey’s Lassa,

Japan’s Yokohama, China’s Westlake, Triangle, Diamond-

back, Double Coin, Grandstone, and Goodyear.

This business unit also has an established regional presence,

with operations covering Iraq, Algeria, and Jordan. Efforts are

ongoing to round out the company’s product offerings, with

more important representations set to come on stream soon.

Despite difficulties faced towards the end of 2015 due to

a foreign currency crunch in Egypt, the Tires business

unit remains an increasingly important contributor to

GB Auto’s revenue and profitability stream, through both

increased sales volume and sustained foreign currency

sales in an environment of devaluation in the company’s

home market of Egypt.

Going forward, GB Auto intends to begin manufacturing

tires, which should allow the company to lock-in supplies

to meet domestic demand and regional demand, especially

in the GCC area, where c.99% of tires sold are imported.

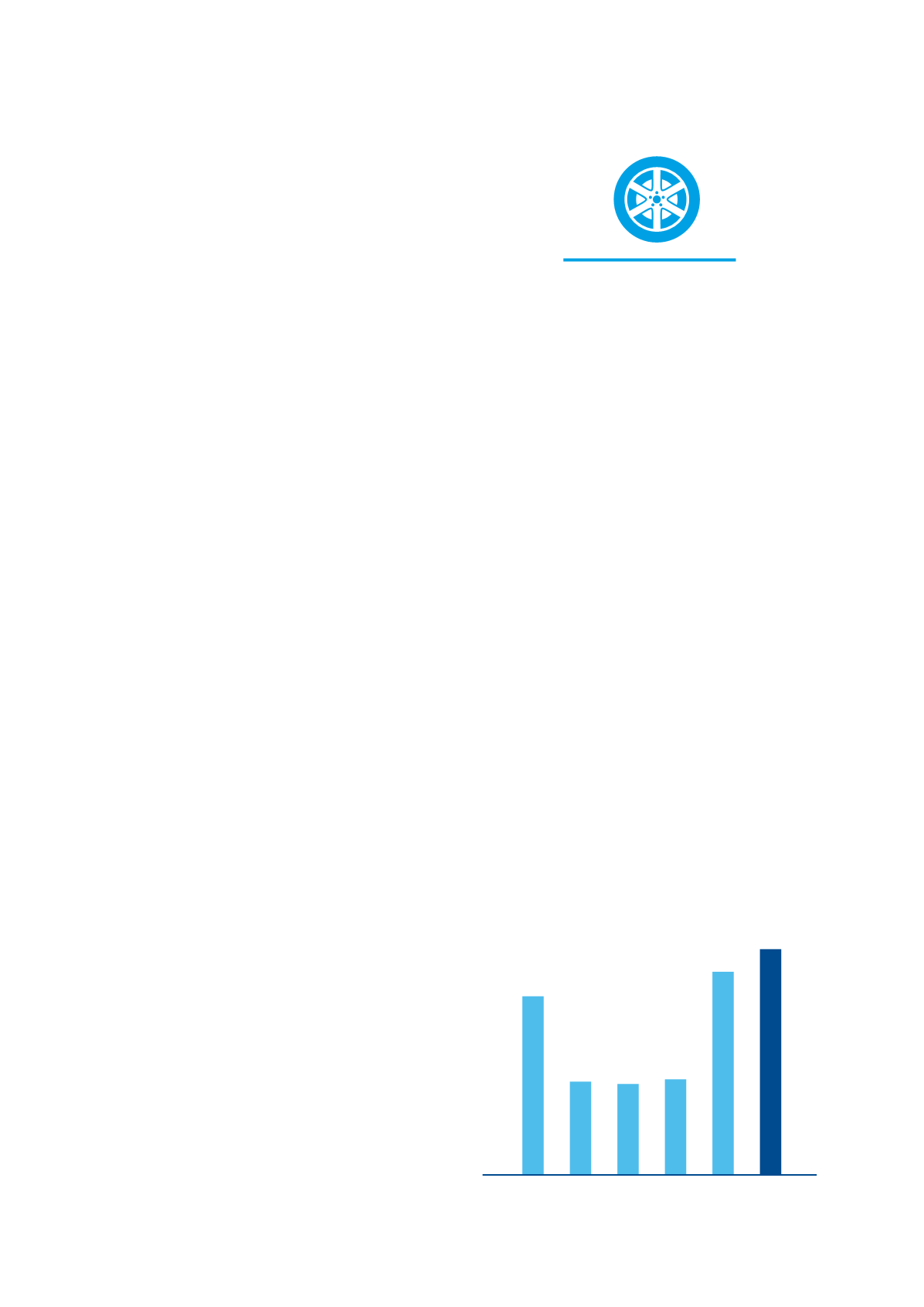

2015 Business Review

2015 was an especially challenging year for GB Auto’s Tires

line of business, as revenues and profitability suffered from

the severe foreign currency shortage in Egypt as well as the

challenging geopolitical conditions in the region. Total sales

revenues dipped 21.9% y-o-y while gross profit decreased

by 43.4% over the same period.

During the second and third quarters of 2015, the company

incurred hefty demurrage charges related to delays in FX

allocation, which – coupled with the liquidation of slow-

moving inventory – adversely affected the Tires business’

top line and margins. Additionally, at the start of the year,

GB Auto had made a strategic and far-sighted decision to

shift payment terms to an all-cash system, which initially

also pressured sales levels. Management, however, expects

this decision to begin bearing fruit as economic conditions,

and in turn demand, begin to gradually improve.

GB Auto is also fine-tuning its overall go-to market ap-

proach through a number of activities aimed at increasing

market share and lifting profitability across the region and

starting 2016 on a more solid footing. Among these efforts

are, 1) the optimization of our brand portfolio to cover

new profitable segments (Double Coin for trucks and light

trucks, OTR tires in Egypt, Avon tires for Passenger Cars

and SUVs in Jordan and Iraq as well as Primo for Agri-tires

in Egypt.); 2) Consolidating our position in the Passenger

Car retail channels to improve the distributed volumes

and cement our position in direct sales to heavy truck

fleets and; 3) Shifting our payment terms to an all-cash

system for 80% of our Egyptian tire business and the re-

organization of our sales force to achieve a more effective

coverage of key areas in Egypt and Algeria.

The company has confirmed its short-term plans to launch

a tire manufacturing facility in the region to lock-in supplies

of products appropriate to its markets while also catering to a

strong local demand in the GCC and MENA regions. Negotia-

tions are ongoing with technology partners to grant the most

suitable product portfolio and competitive cost structure for

the project. Overall required capacity will be above 100,000

tons, in line with our cost competitive strategy.

Tires Revenues by Year

(LE million)

163.4

290.1

390.4

324.4

415.2

111.7

2010 2011 2012 2013

2015

2014

26 | GB Auto |

2015

Our Business Units and Brands