results during 2015, as it continued on its gradual growth

trajectory. Revenues for the year reached LE 433.9 mil-

lion, an increase of 15.9% y-o-y. While the division’s gross

profit rose by 26.7% to LE 150.7 million. Management ex-

pects After-Sales to remain highly profitable and continue

yielding excellent returns. GB Auto intends to establish

additional after-sales outlets in new locations, primarily

underserviced areas such as Upper Egypt and the North

Coast, to meet the ever-increasing capacity that has nearly

doubled over the last two years.

Iraq

GB Auto continues to operate in the Iraqi market despite the

adverse geopolitical conditions that negatively impacted

our operations in the country. Revenues from the market

came in 50.9% lower y-o-y for the full year of 2015 on the

back of a 44.0%decrease in sales volumes, largely due to the

country’s sluggish economic backdrop, affecting market de-

mand as well as oversupply problems. Despite the weaken-

ing demand for Passenger Cars, however, Iraqi After-Sales

performed well during 2015, recording revenues of LE 64.3

million, an increase of 30.7% y-o-y.

From a comparative standpoint, GB Auto’s position in

the Iraqi market is better than most in terms of bank debt,

stocks, and foreign currency. As is the case with many

other businesses in the troubled country, there is limited

visibility on future conditions. GB Auto intends to main-

tain its operations and management is exploring a number

of contingency plans that should allow the company to

tackle whatever challenges that may arise.

Algeria

GB Auto’s operations in Algeria were hampered by a

difficult economic and regulatory climate during 2015.

In addition to a generally sluggish economic backdrop,

Algeria also found itself grappling with a foreign cur-

rency shortage and restrictions on car imports, which the

government temporarily suspended until new legislation

is put in place. The focus of 2015 was on liquidating the

company’s Algerian stock, leaving only 250 units by year-

end, which management intends to sell during the first

half of the coming year.

Despite these challenges, management remains optimistic

about the recovery of this potentially lucrative market and

will continue to pursue additional opportunities for long-

term growth in Algeria.

Libya

Given the increasingly volatile conditions on the ground in

Libya, GB Auto began liquidating its inventory in the coun-

try as it arranged to exit the turbulent market. It is worth

nothing that GB Auto has no personnel in Libya and all

inventory in the country remains fully insured.

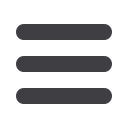

GB Auto Sales Volume Across

All Brands and Markets

(Vehicle Units)

CBU CKD

34,869

44,562

50,103

51,924

22,439

17,749

21,598

28,764

39,135

27,718

38,316

44,645

2010 2011 2012 2013

2015

2014

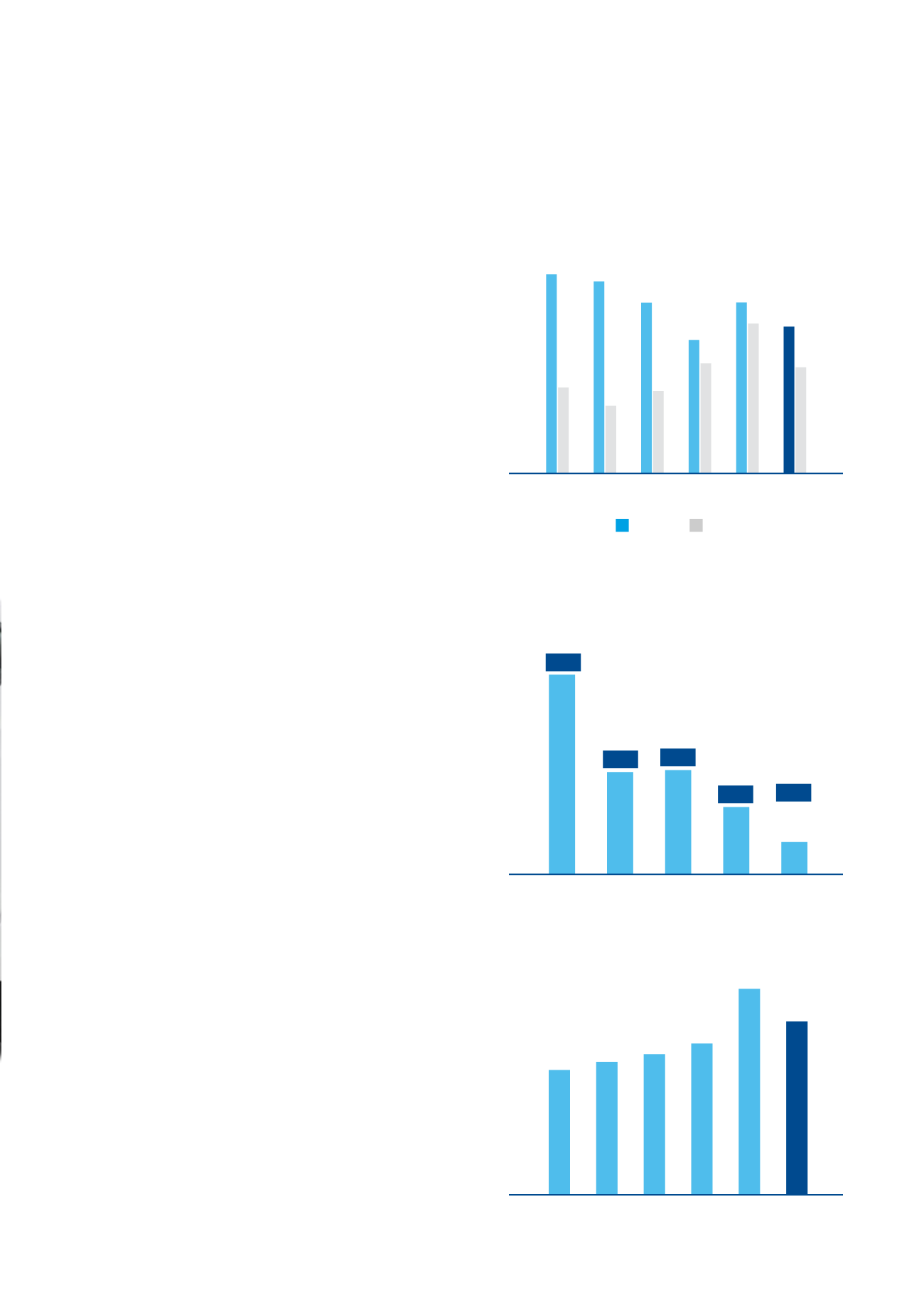

Revenues by Year

(LE million)

5,741.9

6,072.3

6,536.9

7,489.9

8,909.9

5,383.0

2010 2011 2012 2013

2015

2014

Segmentation of the Egyptian

Passenger Car Market

(Units sold and % Market Share as of Year-End 2015)

22,296

1,070.0

22,695

7,128

14,736

43,350

Hyundai Nissan Chevrolet Kia Geely

Emgrand

22.2%

11.4% 11.6%

7.5% 3.6%

21 | GB Auto |

2015