2016 Business Review

Egypt

Despite the foreign currency shortage, the Egyptian pound’s

liberalization impacting the company’s FX costs, and an

overall challenging macroeconomic landscape, GB Auto con-

tinued to reap the benefits of its calculated cost-cutting and

price-increase strategy on its Hyundai, Geely, Mazda, and

Chery brands.

According to the Egyptian Automotive Marketing Informa-

tion Council (AMIC)’s full-year report on the Egyptian pas-

senger car market, the total automotive market fell 27.4% y-

o-y in FY16. More specifically, vehicles within the 1.0-1.3 liter

range witnessed a 54% y-o-y decline in volumes, while those

within the 1.3-1.5 liter range fell 27%. Meanwhile, vehicles

within the 1.5-1.6 liter range saw sales volumes decrease 28%,

while SUVs with an engine capacity larger than 2.0 liters saw

volumes drop 3% y-o-y.

FY16 saw GB Auto’s Egypt Passenger Cars division grow its

sales revenues by 40.3% y-o-y to LE 8,016.1 million despite a

1.2% y-o-y drop in sales volume during the year.

While demand for passenger cars weakened during the year

as a result of the continuing rise in vehicle prices, GB Autowas

still able to grow itsmarket share by capturing existing under-

served demand, after many players in the market decidedly

reduced their stock levels in response to rising FXcosts.

The company’s share of the Egyptian passenger car market,

which includes Hyundai, Geely, Mazda, and Chery, rose to

36.8% YTD in December 2016 compared to 26.8% last year.

The availability of inventory and competitive pricing strate-

gies were key to GB Auto’s success during the year.

Hyundai CBU sales volumes remained almost flat with a

slight decrease of 0.5% y-o-y during the year, while CKD

sales volumes witnessed a 23.5% y-o-y fall. Overall rev-

enues from the brand increased 31.1% y-o-y as the company

introduced gradual price increases to help preserve profit-

ability and margins.

Mazda also did well during the year, with revenues rising

7.7% y-o-y despite a 12.3% y-o-y drop in volumes. Meanwhile,

Geely’s revenues fell 25.8% over FY16 as sales volumes for

both its CBU and CKD units decreased during the year.

Since its launch in March 2016, GB Auto’s latest PC product,

the Chinese Chery vehicle, has delivered promising results

in terms of both profitability and market share. In FY16,

Chery’s market share stood at 5.8% with over 8,000 units

sold in its first year with GB Auto. With the addition of

Chery’s two new CKD models, alongside the Hyundai Elan-

tra, Karry, and Geely, GB Auto now offers five CKD models

compared to only two last year.

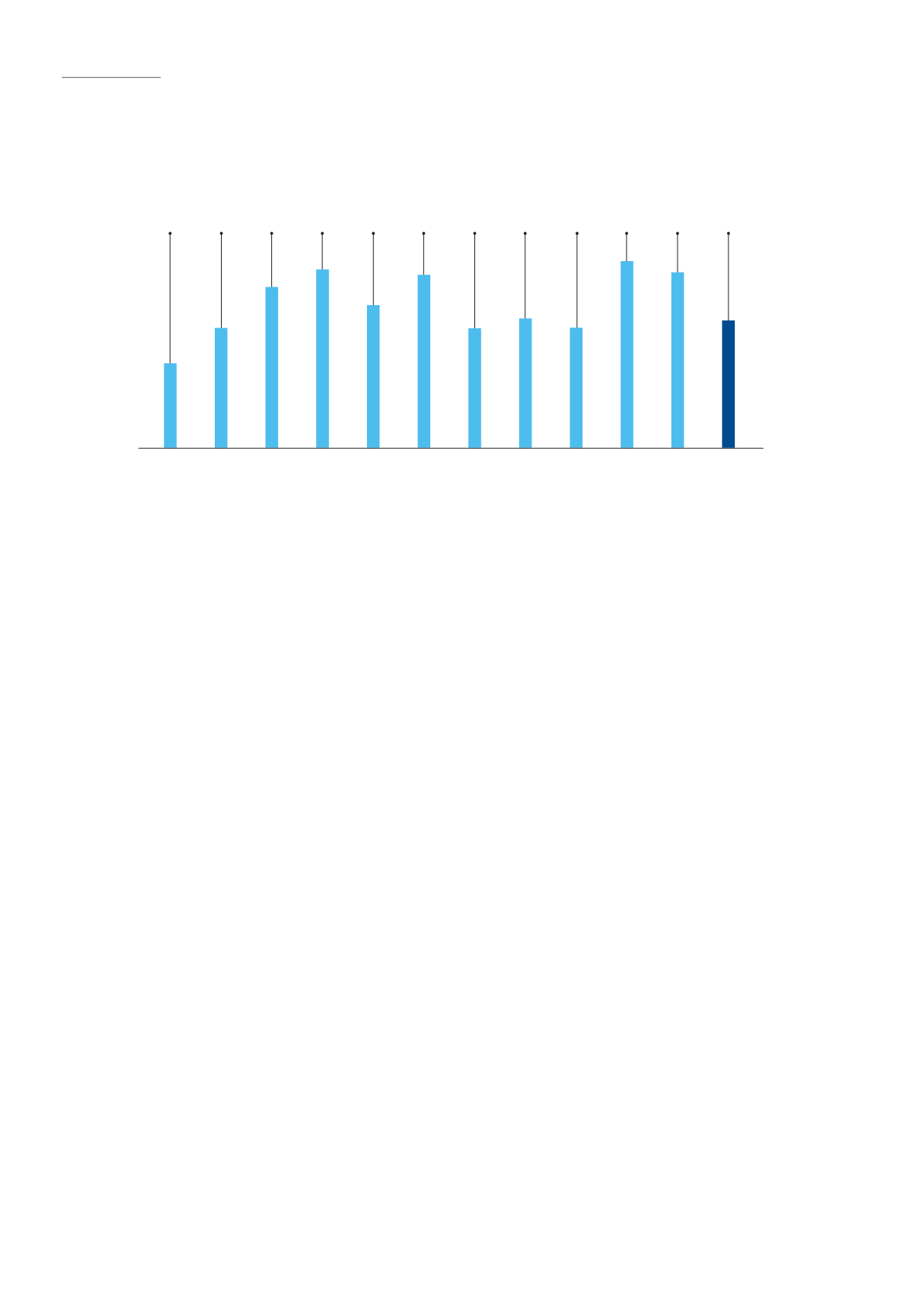

Egyptian PC Market Annual Sales

(LE million)

133,591 179,178 198,800

133,165 144,204 133,760 207,973 195,559 141,983

192,848

158,926

94,332

FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16

2016 ANNUAL REPORT

26

Our Business Units