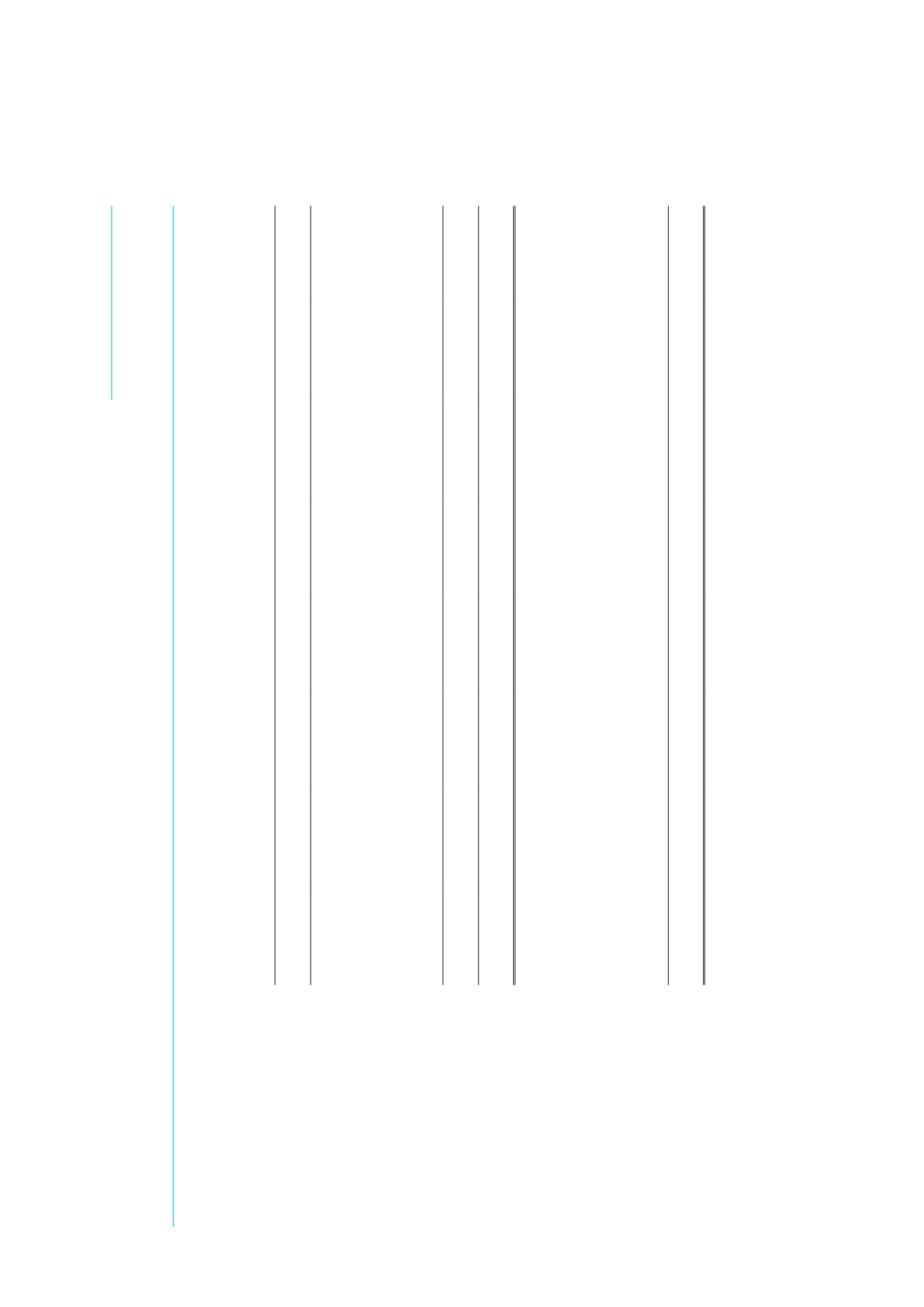

Total

Note

Fixed and

Intangible

Assets

Carried

forward

losses

Impairment

of Inventory

Warranty

Provision

Surplus

revaluation of

fixed assets*

Foreign

exchange

loss

December 31,

2016

December 31,

2015

Deferred tax assets

Balance at 1 January

825

15 063

9 910

14 842

-

-

40640

35 517

Reclass

(814)

814

-

-

-

-

-

-

Charged to the income

statement

-

(6 005)

(2 455)

5 177

-

121 998

118 715

5 123

Balance at the endof

the year

11

9872

7455

20019

-

121 998

159 355

40640

Deferred tax liabilities

Balance at 1 January

(82 926)

-

-

-

-

-

(82926)

(85 464)

Charged to the income

statement

(20 300)

-

-

-

-

-

(20 300)

2 538

Charged to Statement

of comprehensive

income

-

-

-

-

(61 163)

-

(61 163)

-

Balance at the endof

the year

(103 226)

-

-

-

(61 163)

-

(164 389)

(82926)

Net deferred tax

liabilities

(103 215)

9872

7455

20019

(61 163)

121 998

(5 034)

(42286)

Net

Balance at 1 January

(82 101)

15 063

9910

14842

-

-

(42286)

(49947)

Reclass

(814)

814

-

-

-

-

-

-

Charged to the income

statement

(9-C)

(20 300)

(6 005)

(2 455)

5 177

-

121 998

98415

7 661

Charged to Statement

of comprehensive

income

-

-

-

-

(61 163)

-

(61 163)

-

Balance at the endof

the year

(103 215)

9872

7455

20019

(61 163)

121 998

(5 034)

(42286)

* Deferred tax expense on surplus revaluation of fixed assets is charged to consolidated statement of comprehensive income.

B Deferred tax assets and liabilities

2016 ANNUAL REPORT

77

GB Auto (S.A.E.)

Notes to the consolidated financial statements for the financial year ended December 31, 2016

(In thenotes all amounts are shown inThousandEgyptianPounds unless otherwise stated)