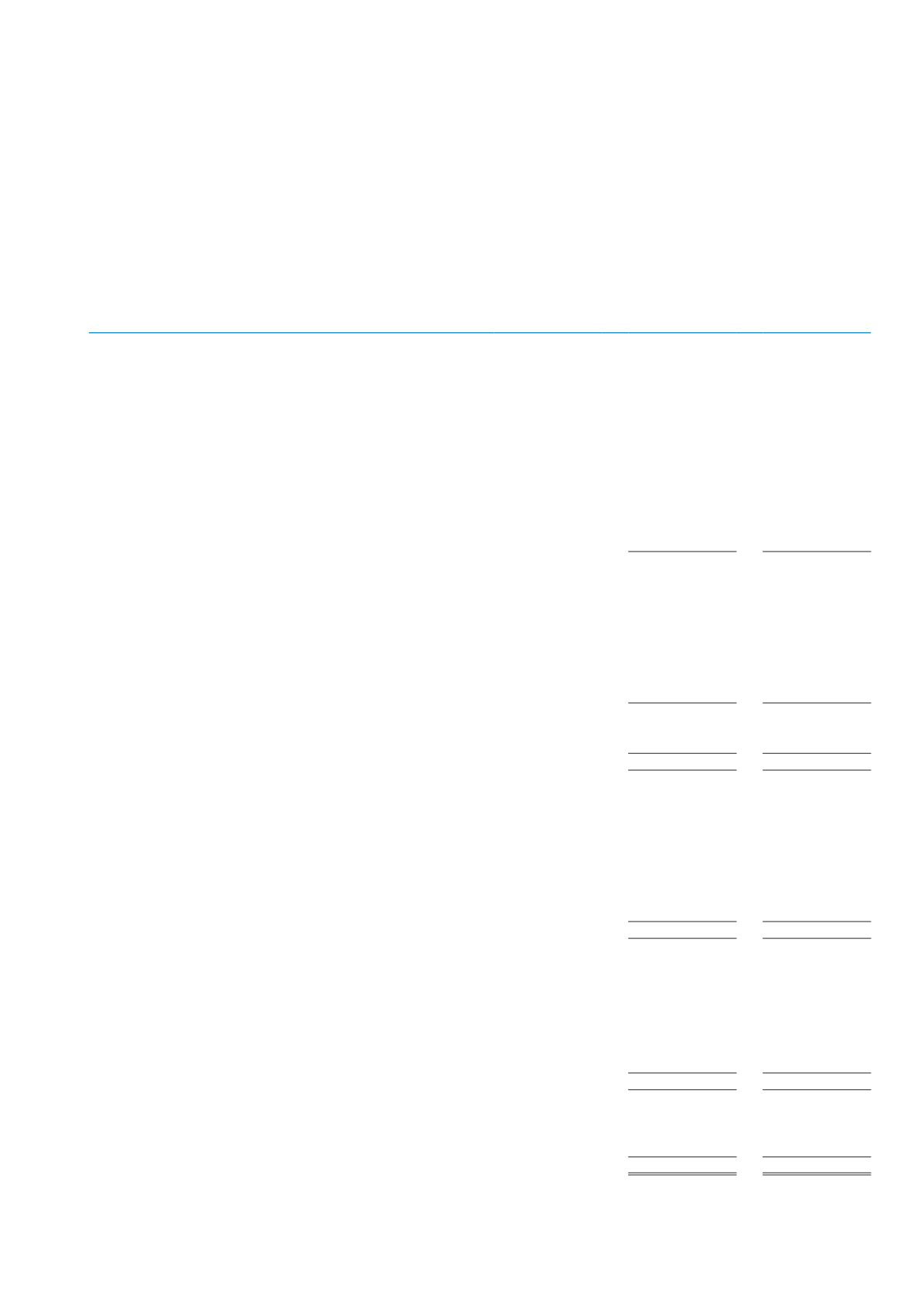

Consolidated statement

of cash flow

for financial year ended December 31, 2014

(All amounts in thousand Egyptian Pounds)

Note

December

31, 2014

December

31, 2013

restated

Cash flows from operating activities

Net profit for the year before tax

325 896

214 175

Adjustments

Interest expense

(31)

367 503

379 225

Depreciation and amortization

(5/6)

199 145

152 259

Bond issuance cost amortization

(31)

11 575

2 571

Provisions - net

(30)

60 922

12 400

Impairment of current assets - net

16 182

-

Interest income

(31)

( 8 961)

( 24 016)

Loans capitalized interest

(5 271)

(11 928)

Revenue amortization - Sale and lease back

(9 101)

(6 959)

Revenue amortization - Property Investment

1 110

-

Gain on sale of fixed assets and assets held for sale

( 820)

( 103)

Net profit before changes in working capital

958 180

717 624

Changes in working capital

Inventories

(234 189)

(423 784)

Accounts and notes receivables

(565 816)

(207 485)

Debtors and other debit balances

(276 636)

(27 078)

Due from related parties

(27 037)

3 443

Due to related parties

( 6 737)

730

Trade payables and other credit balances

(79 775)

126 531

Provisions used

(13 155)

( 5 739)

Cash flows (used in)/ generated from operating activities

(245 165)

184 242

Income tax paid during the year

(22 306)

(12 536)

Dividends paid to Employee

(42 240)

-

Net cash flows (used in)/ generated from operating activities

(309 711)

171 706

Cash flows from investing activities

Purchase of property, plant and equipment

(870 859)

(872 889)

Purchase of minority

(1 114)

-

Payments for projects under constructions

(138 037)

(82 612)

Purchase of intangible assets

(1 262)

(4 332)

Interest received

8 961

23 539

Proceeds from sale of assets held for sale

1 400

1 534

Proceeds from sale of property, plant and equipment

31 532

396 536

Net cash flow (used in) investing activities

(969 379)

(538 224)

Cash flows from financing activities

Loans and borrowings

2 083 175

1 099 441

Paid from minority to increase capital of subsidiaries

1 566

138 434

Bonds liabilities

(316 696)

(307 691)

Interest Paid

(356 358)

(377 842)

Dividends paid

(34 221)

(301 780)

Long-term notes payables

( 150)

( 113 886)

Net cash flows generated from financing activities

1 377 316

136 676

Net increase/(decrease) in cash and cash equivalents

98 226

(229 842)

Cash and cash equivalents at beginning of the year

1 085 105

1 264 734

Impact of translation differences on cash and cash equivalents

( 5 754)

50 213

Cash and cash equivalents at end of the year

(3/10,16-B)

1 177 577

1 085 105

* The accompanying notes form an integral part of these consolidated financial statements, and to be read therewith.

Ghabbour Auto | 2014 ANNUAL REPORT

53