profitable business divisions. In particu-

lar, as the company continues to invest

in higher-margin activities management

foresees an improvement in net profit

margins, noting that we cannot foresee

the impact of extraordinary events.

The company’s ambitious investment

plans are set to start shortly after the

capital increase.

Latest Corporate

Developments

1) GB Auto Shareholders Approve

c.LE960 Million Capital Increase

GB Auto’s extraordinary general as-

sembly of shareholders approved a

c.LE960 million rights issue that will

see the company’s issued capital rise

to LE 1.095 billion. Proceeds from the

capital raising will be used to fuel the

company’s drive to grow its Tires and

Motorcycles & Three-Wheelers busi-

nesses, allowing GB Auto to build a

new two- and three-wheelers plant to

allow full CKD assembly; to deepen

the group’s presence in the tires line

of business through entering the tire

manufacturing business; and to pur-

sue additional expansion opportuni-

ties in select businesses.

2) GB Auto Ranks 2nd Place for In-

vestor Relations in Egypt

GB Auto was honored with a second-

place ranking in the “Best Company

for Investor Relations in Egypt in

2014” awards category at Middle East

Investor Relations Society’s Annual

Conference and Awards ceremony on

27 November 2014 at the DIFC Confer-

ence Centre in Dubai. Management

considers it noteworthy that there

was only a one percentage point dif-

ference between GB and the company

that took first place.

Moreover, GB Auto’s Investor Rela-

tions Manager, Hoda Yehia, was named

Best Investor Relations Professional in

Egypt for the year 2014.

The Awards, carried out in collabora-

tion with Thomson Reuters Extel, recog-

nize the efforts of regional companies and

IR professionals who play a critical role in

developing investor relations. The event

is the largest IR conference in the Middle

East and has been held annually for the

past five years. It is attended by delegates

from across the region and beyond.

Outlook

Given the fundamental strengths sup-

porting Egypt’s economy, including a

population of 90 million people, a key

geographic position and basket of free

trade agreements, GB Auto sees real

growth potential in the Egyptian market

and is continuing to invest accordingly.

In that vein, management has sought

and received approval for an LE 960

million capital increase to fund con-

struction of two new facilities. The first

will be a wholly-owned plant that will

assemble motorcycles and three-wheel-

ers, which management believes to be

the first of its kind outside of India for

Bajaj. The second will be a new tires

manufacturing facility. Both plants will

open new opportunities for GB Auto in

these fast-growing lines of business.

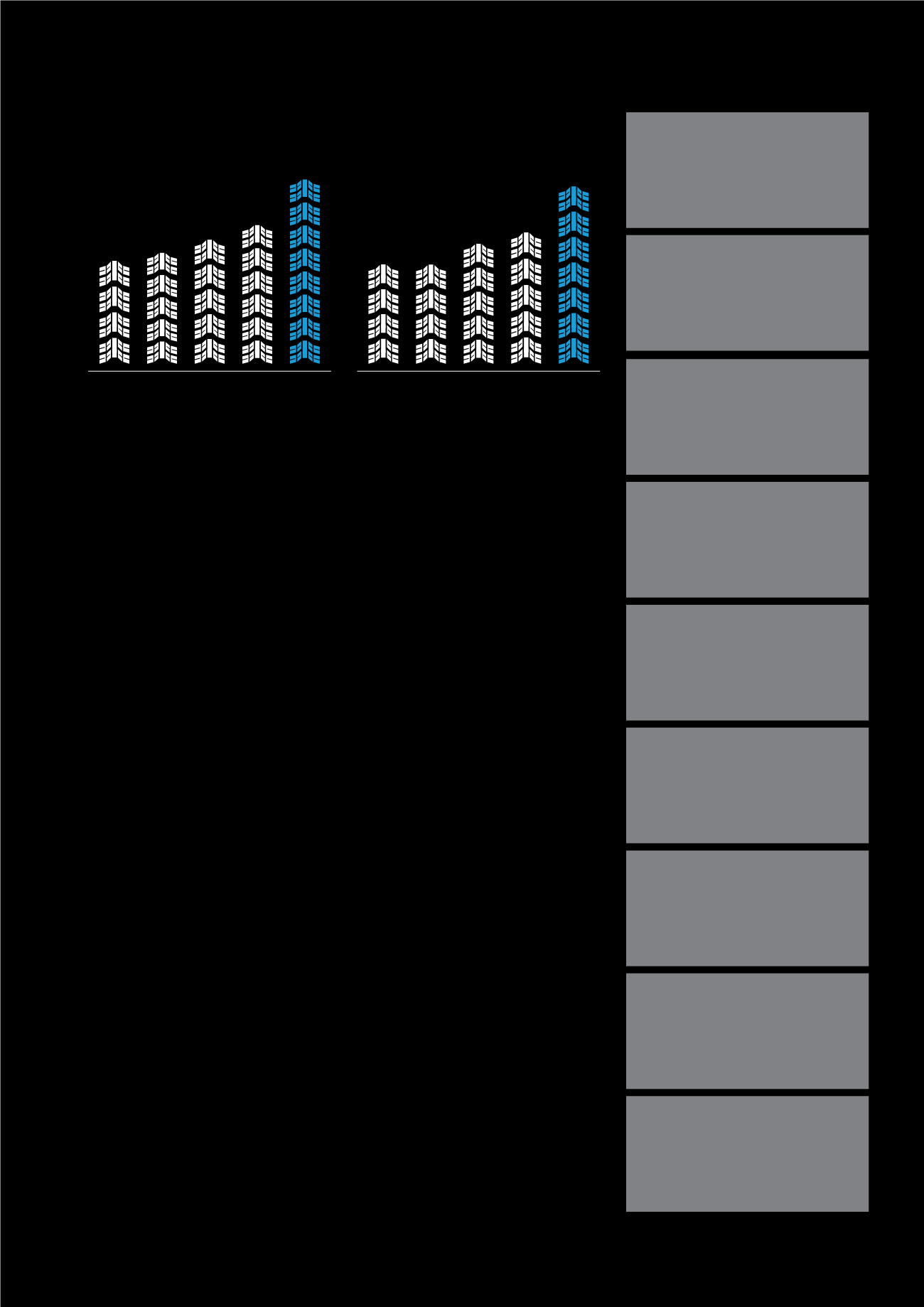

2014 Highlights

Group Revenues by Year

(LE million)

Group Gross Profits by Year

(LE million)

35.0

%

Revenue Increase

FY10

6,873.8

885.4 883.3

1,070.0

1,170.3

1,581.7

7,416.3

8,290.1

9,126.7

12,322.1

FY10

FY11

FY11

FY12

FY12

FY13

FY13

FY14

FY14

GB Auto’s revenue rose 35.0% to LE

12,322.1 mn in FY14

174.0

mn

Net Income

Net income was LE 174.0 mn in FY14, a

50.0% rise over FY13

36.3

%

Improvement

Passenger Cars revenue saw a 36.3%

improvement year-on-year in FY14

1.3

bn

Motorcycles & Three-Wheelers Revenue

Motorcycles &Three-Wheelers revenue

increased 8.5% in FY14 to LE 1.3 bn

89.8

%

CV&CE Revenue Increase

Commercial Vehicles & Construction

Equipment revenues rose 89.8% in FY14

415.2

mn

Tires Revenue in FY14

Tires revenues were LE 415.2 mn in

FY14, a 6.4% improvement y-o-y

722.7

mn

Financing Businesses Revenue

Revenues of LE 722.7 mn in FY14 were a

49.0% improvement y-o-y

27.4

mn

Others Revenues

The Others line of business revenues

registered at LE 27.4 mn in FY14

1.4

%

Net Profit Margin

GB Auto’s net profit margin was 1.4% in

FY14, a slight increase y-o-y

Ghabbour Auto | 2014 ANNUAL REPORT

9